Table of Content

Choose from fixed or adjustable rates without paying mortgage insurance or making a down payment. Find out how a car loan would impact your monthly payment with the Auto Loan Calculator from Hawaii Community Federal Credit Union. A fixed-rate mortgage gives you predictable payments for greater peace of mind. Your rate is protected from rising interest rates so you can have a set budget for your mortgage. By clicking the "OK" link below, you acknowledge that you are leaving ccu.com. Please refer to the Terms of Use and Privacy Policy for this outside website.

Adoptions, weddings, emergency funds — that’s why we call it the “anything” loan. Through our wholly-owned service organization, California Members Title Company provides local, personalized, low-cost services for all your title and escrow needs. Using an updated version will help protect your accounts and provide a better experience. Just paid my loan online and it couldn't have been any easier.

End-of-the-Year Money Moves

Payment terms up to 180 months on the fixed portion of your balance. This credit union is federally insured by the National Credit Union Administration. This is done to ensure that any final value in the appraisal will not be improperly influenced by any parties involved in the origination of the loan. We’ll pay up to $10,0001 of your closing costs when you select either a 5/5, 7/6, or 10/6 Adjustable Rate Mortgage , fixed for the first 5, 7, or 10 years. Offer good for a limited time and is valid for owner-occupied or second homes.

If you don’t have the cash for a large down payment, this is an excellent option because the minimum down payment percentage is lower than a conventional mortgage. We highly recommend this loan for first-time homebuyers. Our variety of credit card options offer you low rates and high rewards.

Ready to grow your mortgage business?

Apply online today for a home equity loan or line of credit from City & County Credit Union. The best loan for first time home buyers is often a loan that requires a low down payment or no down payment. To determine the best mortgage option for your specific needs or to ask a question, get in touch with the UCU mortgage team. Purchasing a new home is exciting, but it can feel overwhelming. That’s why our mortgage team is available to help you navigate through the process with ease.

Imagine what it will feel like when more of your members start to obtain their mortgages through your credit union. Most members' mortgages aren't with their credit union. When you take the current value of your home, minus the amount you owe, that’s a good estimate of how much equity you have invested. The equity you’ve built can potentially be used in a variety of ways, such as debt consolidation, home improvement projects, weddings, medical bills, vacations, and emergency funds. Use our calculatorto get an idea of how much equity you might have to work with.

Considering offering mortgages to your members?

Please note that all ARM loans are subject to credit approval and membership eligibility. Rates, terms, and conditions are subject to change. This Relationship Pricing Discount is subject to change without notice. Contact us to find out more about our Relationship Pricing Discount.

From dream vacations to your everyday wish list, our flexible lending options can help put your goals into motion faster. You can access the funds online to pay for whatever you need, whenever you need it. If you have equity in your home, you can tap into your home’s equity and make it work for you. Borrow up to 80% of your home’s equity with a $25,000 minimum loan amount and pay no annual fees. Our mortgages offer the flexibility and support you need to find your perfect home.

Closing Costs Calculator

The site you are about to visit is not operated by UCU. Please refer to the Terms of Use and Privacy Policy for this outside website as they may differ from UCU’s. UCU does not endorse and assumes no liability for any alternate website’s content and does not represent either the third-party or the member if the two enter into a transaction. And with state-of-the art technology, you’ll offer members a secure and reliable online experience – all handled for you, by us. Keep your business rolling with a great, low rate on a business vehicle loan.

Once you’ve found the rate that’s right for you, apply online to get pre-qualified. Find out if you could lower your auto loan payment. We’ve built our business by helping hundreds of credit union partners become better mortgage lenders. Monster mortgage lenders, as we like to call them.

Take a look at all of our loan and deposit rates, all in one place. A mortgage with us could help you increase your share, with qualified mortgage households earning an average Profit Payout1 of $277. Use our land loan calculator and get an instant quote on a lot loan. Secure your perfect piece of land and start building.

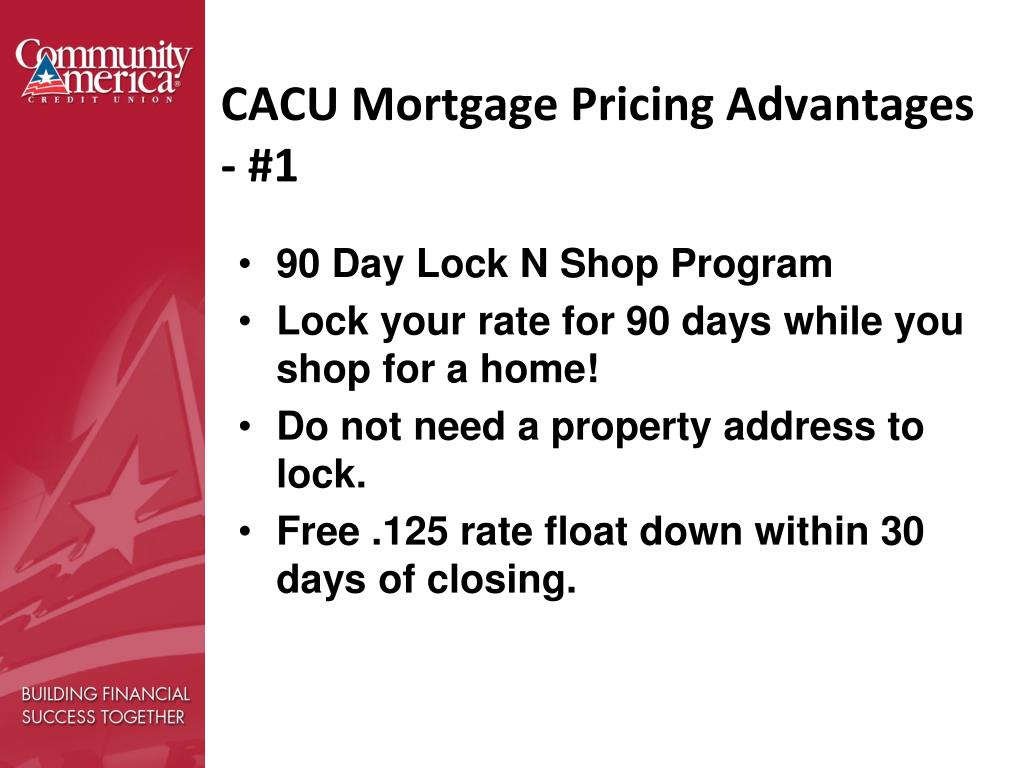

A financial institution will lend money to a qualified borrower, using the property as collateral. The borrower must pay back the balance plus interest over an agreed upon term. However, if payments stop, the lender will take ownership of the property. Be ready when you find the house that’s right for you by getting pre-qualified for a mortgage with CommunityAmerica.

Do the math to find out your potential monthly mortgage payment. One of the first steps in the mortgage process is figuring out whether a fixed rate or an adjustable rate is right for your situation. Crunch the numbers to see your potential monthly mortgage payment. Use our auto refinance calculator to help you decide if it would be worth it for you to refinance your auto loan. CommonWealth One Federal Credit Union offers VA and Washington D.C. Homeowners a variety of low-cost home equity loans.

If you’re a Kansas City resident, try out CommunityAmerica’s mortgage refinance calculator to see if this option makes sense for you. Try the CommunityAmerica Lease or Buy Calculator to help make the best financial decision. Home equity financing can help pay for home renovations,. Education expenses, a daughter’s wedding, or a new business.

No comments:

Post a Comment